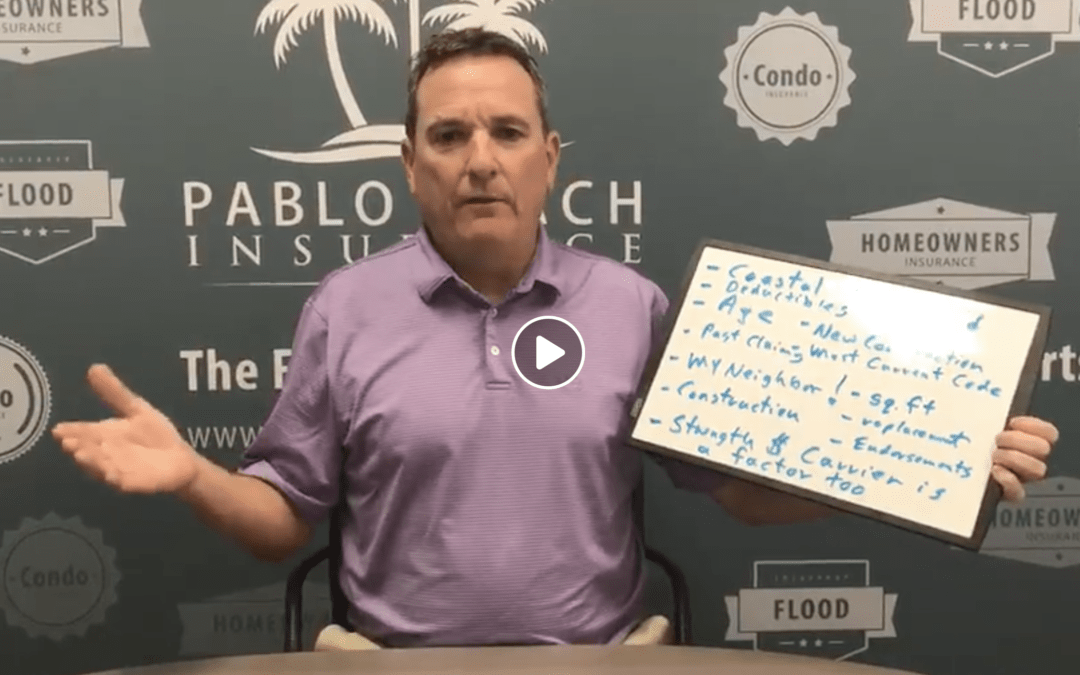

Today we discuss the differences in the cost of homeowner’s insurance. This was recently done by Shaun Murphy on “Whiteboard Wednesday” with Pablo Beach Insurance.

There are a lot of factors that go into the pricing or cost of a homeowner’s insurance policy. Due to that, there is often times a lot of confusion about it. Sometimes we get calls and someone says, “my neighbor and me, we’ve got the same coverage and my premium is higher than theirs”, or “their premium is higher than mine, why is that?”.

Factors that affect the pricing of home insurance

Well, there’s a lot of factors that contribute to the costs of your homeowner’s insurance.

- One could be deductibles – the higher deductible, the lower your cost.

- Another could be past claims. If you’ve got a claim history, you might be paying a little bit more.

- Construction type is another factor – frame versus a masonry construction. A masonry or brick home would be less expensive to insure than a frame home.

- Another factor could be coastal versus inland. Obviously, if you’re close to the coast here in the state of Florida, your costs are going to be a little bit more than if you were 20 miles inland.

- There’s also the possibility of, the strength of your carrier. The stronger the carrier, maybe the better rates.

So if you need any more information about your Insurance or want to shop your homeowner’s insurance, let us know. I hope this helps.

How Much Does Homeowners Insurance Cost?

There are a lot of factors that go into the pricing of your homeowners #insurance. Let's have a look at the common ones today on #WhiteboardWednesday.

Posted by Pablo Beach Insurance Group on Wednesday, August 15, 2018

Florida Home Insurance Experts

For over 15 years, PBIG has been helping Florida residents by getting them the right coverage at the right price. We are locally owned, have a casual approach, and deliver professional results. Click below to get a no-hassle, free quote from one of our experts.